Improving the Financial health of India's Airline Industry through a reduction in the

Cost of ATF in India

An Issues Paper

An Issues Paper

ATF is a major cost component for Airlines in India – being about 40% of the operating cost of the domestic carriers. The estimated annual fuel bill for the industry is around USD 1.7 billion, based on September 2006 rates.

Excessive ATF rates in India over the years have hurt the financial health of the domestic airlines and contributed to their accumulated losses.

Comparative ATF Rates (2007 - 2004)

| Bangkok | Singapore | Kuala Lumpur | Sharjah | India | |

| Rs 21,272 / kl | Rs 20,779 / kl | Rs 20,874 / kl | Rs 21,700 / kl | Rs 36,100 / kl | Mar 07 |

| 69% 73% 72% 66% differential %age | |||||

| Rs 22,383 / kl | Rs 22,111 / kl | Rs 21,427 / kl | Rs 23,017 / kl | Rs 37,000 / kl | Mar 06 |

| 65% 67% 72% 60% differential %age | |||||

| Rs 16,069 / kl | Rs 15,816 / kl | Rs 15,589/ kl | Rs 16,349 / kl | Rs 27,400 / kl | Mar 05 |

| 70%& 73% 75% 67% differential %age | |||||

| Rs 11,499 / kl | Rs 11,272 / kl | Rs 11,044 / kl | Rs 11,697 / kl | Rs 21,200 / kl | Apr 04 |

| 84% 88% 91% 81% differential %age | |||||

Even the bonded price of ATF for international flights in India, is priced higher than what is prevailing in the international market.

ATF prices in India (Apr 2007)

| Domestic Flights | International Flights (ex India) | International Price |

| Rs. 37,800 / kilolitre | Rs. 29,050 / kilolitre | Rs. 21,800 / kilolitre |

The ATF price in India is Rs 37,800 per kilolitre as against the international price of Rs 21,800 per kilolitre, which is about 73% higher (at April'07 prices). ATF prices for domestic operations in India are unduly higher than international benchmarks; and the impact of the excessively priced ATF in India has been adverse on the financial health of India's domestic airlines. The high cost of ATF coupled with the high airport charges in India have adversely affected Indian airports' prospects of emerging as global / regional aviation hubs.

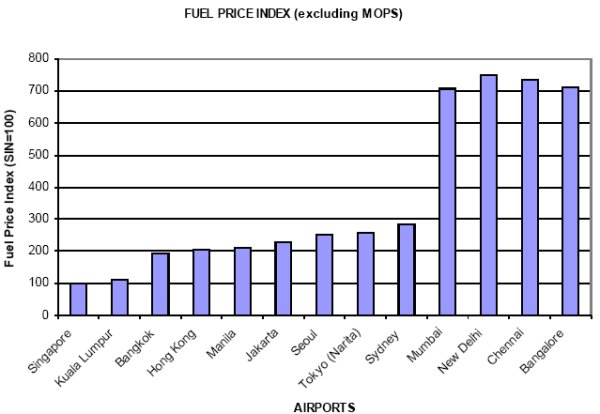

This chart below compares the fuel prices at various airports in the Asia Pacific region; and is based on April 2006 average fuel price data submitted to IATA, by 5 international airlines with operations to India. The comparison is on the portion excluding the Platts marker (Mean of Platts Singapore or MOPS) – referred to as the "differential". For April 2006, the differential at Indian airports are about 7 times higher than that in Singapore – contributing to substantial additional costs for the airlines.

There are a host of elements, which all contribute to raising the cost of ATF in India to levels which make airlines in India lose competitiveness.

The ATF Pricing mechanism in India:

Following the dismantling of the ‘Administered Price Mechanism' (APM) effective April 2001, the prices of ATF in India are based on the "International Import Parity Prices", and directly linked to the benchmark of Platt's publication of FOB Arabian Gulf ATF prices (AG); and do not relate to the actual cost of producing ATF in India.

ATF prices for domestic operations also include Freight charges from Gulf to India; Customs Duty of 10% ad valorem (which adds up to an effective rate of approx 20% inclusive of the CVD & cess); domestic transportation and other charges; Excise Duty of 8.24% (including cess); Sales Tax (levied by the State Governments) averaging across the country at 25% as add-ons to the AG prices, besides the Oil Companies' marketing margin; and throughput charges paid to the Airports Authority.

Customs Duty:

India is an ATF surplus country, with its production being higher than the consumption of ATF in the country. Even though the ATF supplied at Indian airports (both for domestic and international operations) is not imported into India but is the product of crude refined in Indian refineries from imported crude, the Customs Duty of 10 % ad valorem (effective duty of approx 20% inclusive of the CVD & cess) is taken into account in fixing the prices of ATF supplied to the airline operators.

- Customs Duty Exemption for ATF uplifted for International flights: In April 2006, ATF uplifted by foreign bound aircraft was declared as a "DEEMED EXPORT". The fuel suppliers, as per this notification were made eligible for exemption of custom duty at the time of importing crude (input material for ATF). However, till date the Oil Companies have not passed on any benefit to the airlines. ATF suppliers for international flights at airports in India, namely the 3 Government owned oil companies, need to immediately adjust their pricing accordingly, so that airlines can derive the resultant benefits.

Excise Duty:

An Excise Duty of 8.24% (including cess) is levied on ATF. Given that the crude prices have increased by around 40% between January 2005 and September 2006 as well as the increase in the number of flights operated by domestic carriers in India by over 50%, the revenue collections by the center has also increased significantly over this period.

- Cenvat Credit for Excise Duty paid on ATF: The Service Tax Department has advised that credit of Excise duty paid on ATF is not available under the provisions of the CENVAT Credit Rules, 2004 ("CCR, 2004") as is in force today. This view is contrary to the language and scope of the provisions of the CCR, 2004, in terms of which credit of Excise duty is available in respect of all "Inputs" other than specifically excluded inputs. This has also been substantiated by an Opinion obtained from reputed tax consultants.

- Non-allowance of credit to the airlines on ATF is against the fundamental principle of the CENVAT provisions, which may result in the cascading effect of taxes. In this regard, a representation has been filed by an FIA member airline, with the Ministry of Finance on 28th August'2006 submitting that ATF credit is available to an Airline Company in terms of Rule 3 of the CCR, 2004; that ATF is distinct from LDO, HDO and Motor spirit and as such ATF is not specifically excluded under the definition of inputs under CCR, 2004; that ATF is received at the premises of airlines i.e. at the various Airports in the country, where the airlines have their offices / operations; and ATF is used as an "Input" for providing taxable service.

Sales Tax:

Sales Tax on ATF for Indian carriers flying international routes has already been withdrawn. The situation needs to be redressed for the domestic flights as well.

While the VAT rates on inputs & final products across the different states have been set at 4 % & 12.5%, the VAT act allows special rates to be charged for fuel and ATF under Schedule-III of the state VAT Acts. This has allowed states to charge sales tax on ATF at excessively high levels.

Sales Tax Rate on ATF

| Northern States | Eastern States | Western States | Southern States | ||||

| Rajasthan | 28% | Bihar | 29% | Gujarat | 30% | Andhra Pradesh | 33% |

| Himachal | 25% | West Bengal | 25% | Maharashtra | 25% | Tamil Nadu | 29% |

| UP | 21% | Chhatisgarh | 25% | Madhya Pradesh | 28.75% | Karnataka | 28% |

| Delhi | 20% | Assam | 22% | Goa | 20% | Kerela | 28.75% |

| Punjab | 20% | Nagaland | 15% | Andaman | 0% | ||

| Mizoram | 0% | ||||||

ATF sold to turbo-prop aircraft was categorized as Declared Goods under the Central Sales Tax Act. Union Budget 2007-08 has also accorded the same benefit to regional jets with a take-off mass less than 40,000 kg. If ATF altogether is given a "declared goods" status, it would attract a uniform 4% sales tax across India.

In an environment where the cost of ATF itself has gone up by 70% (between Mar 04 & Mar 07), coupled with a 58% increase in the fleet of aircraft population in India, the states have an opportunity to provide a fillip to aviation activity by reducing the sales tax rate substantially – without adversely affecting the contribution of ATF sales tax revenue to the state exchequer.

A quick calculation of the revenue from sales tax on ATF which the states earn, is indicative of how the contribution to the state exchequer has grown manifold. The below calculation for Mumbai presumes that at-least 50% of the total aircraft fleet is uplifting fuel in Mumbai; and for Hyderabad that at-least 15% of the aircraft fleet is uplifting fuel in the city. Mumbai has a sales tax rate of 25 % on ATF, while Hyderabad has a rate of 33%. The aircraft population in Mar 2004 was 195, which has grown to 310 aircraft in Mar 07.

| Mumbai: |

Mar 04: Rs 21,200/kl X 97 aircraft X .25 = Rs 5,14,100 Mar 07: Rs 36,100/kl X 155 aircraft X .25 = Rs 13,98,875 |

| Hyderabad: |

Mar 04: Rs 21,200/kl X 29 aircraft X .33 = Rs 2,02,884 Mar 07: Rs 36,100/kl X 46 aircraft X .33 = Rs 5,47,998 |

While these are not the actual absolute amounts of estimated fuel uplifted at the 2 centres, the calculation does reveals that between Mar 04 & Mar 07, the sales tax contribution of ATF to the state exchequer has increased by 172% in the case of Mumbai & by 170% in the case of Hyderabad.

An evidence of the correlation between the sales tax rate & the level of fuel uplifted from a particular centre is available from the fact that a reduction in sales tax rate to 4% in 2002-03 in Andhra Pradesh, led to an over-50% increase in fuel uplifted from Hyderabad by the country's major carriers.

Lack of Transparency in pricing:

Based on the import parity pricing mechanism, changes in domestic rates should be similar to the changes experienced in AG prices. However, in the majority of such instances, when there are increases in benchmark oil prices, the corresponding increase passed on to airlines in India are higher than the increase in benchmark prices. Conversely, when benchmark prices have been reduced, the corresponding decreases have not been fully passed on to airline operators in India.

Whilst from April 2005 to October 2006, the benchmark prices have reflected a net increase of 16.2%, the oil companies have passed on a net increase of 31.6% to domestic airlines in India.

The oil companies also add high margins towards handling & distribution costs to fix the basic price of ATF in a non-transparent manner. This clearly demonstrates the lack of transparency in the pricing mechanism. The Indian ATF supply market needs to move towards a transparent pricing structure based on an international jet fuel price marker (e.g. Mean of Platts Arab Gulf) plus a differential as practiced at most major airports around the world.

The hike in ATF charges applicable for May 2007 announced by the oil companies, provides more evidence of the lack of transparency in determination of the ATF price. The differential change month-on-month between the domestic price of ATF and the bonded price, has been approximately the same. For example, if the domestic ATF price went up by 4.71% between Mar to Apr 2007, the bonded price went up by 5.44%. For May 2007 however, while the domestic ATF price has increased by Rs 1350 (3.6% hike) over Apr 07, the bonded price for ATF has increased by double this amount to Rs 2700 (a 9.3% hike) over the previous month.

Monopoly of PSU Oil companies:

A major reason for high price even after deregulation of ATF price, is the monopoly of the 3 state owned Oil companies. Because of limited number of suppliers there has hardly been any effective choice for the airline industry, with the 3 state owned oil companies fixing the ATF price on a mutually agreed common formula between them.

The government has granted marketing rights to some companies in the oil sector like Reliance, Essar, ONGC etc. None of these companies however, could start supply of ATF as they were not allotted space by the Airport Authority. Recently Reliance has been allotted land at 25 airports in India; and is moving towards setting up Aviation Fuelling stations at some of these airports.

It is hoped that the resultant competition will bring about a reduction in the unreasonable ATF price levels prevalent in India.

Lack of Open access for fuel supply through a Common Distribution Infrastructure:

In order to enable the private oil companies to supply ATF to airlines at Indian airports, it is necessary to make suitable distribution infrastructure & facilities available at the airports, including common terminals for ATF distribution. Additionally, installation of Hydrant Fuel Dispensation systems (as opposed to current bowser based systems) should be undertaken on a priority basis. The entire logistics for supply of fuel to Indian airports should be properly scrutinized to ensure that no supplier has a stranglehold on any portion of the supply infrastructure (e.g. pipelines to the airport) that would hinder the entry of competition. Without the same, simply granting marketing rights to new oil companies will not have any meaningful impact on bringing about competition led decrease in ATF prices.

The Naresh Chandra ‘Committee on a Road Map for the Civil Aviation sector' had earlier recommended that the Airport Authority of India (AAI) could buy out the distribution infrastructure of the state-owned oil companies and provide all oil companies equitable access to such facilities. Alternately, the state-owned oil companies should be required to provide private oil companies access to these facilities on a "common user / carrier" principle. In either case, the Committee had suggested that fuel supply infrastructure at airports should come under the purview of the proposed AERA – Airport Economic Regulatory Authority.

This would result in improved efficiencies, reduced delays for airlines, & cost reduction for the oil companies.

Throughput charges & bidding processes:

A throughput fee is being levied by Airport Authority of India (AAI) on oil companies. Whilst oil companies are expected to absorb this throughput fee, in practice, it is simply passed through in entirety to the airlines. This throughput fee is an unnecessary base cost which adds to the total price of ATF applicable to the Airlines.

Recent competitive bidding exercises for erecting fuel facilities at select airports use throughput fee as a criterion for tender award. A supplier that bids the highest throughput fee wins the tender and the winning throughput fee is then similarly applied to all the existing fuel suppliers at the airport concerned.

There is a serious flaw in using throughput fee as an award criterion. Since the bidders (the oil companies) are not the ultimate payers of the throughput fee, they would have no qualms in submitting incredulously high bids. Recent tenders at MAA & CCU based on throughput fee at airports resulted in bids which were 21 and 17 times higher than existing throughput fees respectively. In unit price terms, an award of license to bring in an additional fuel supplier would result in a higher cost of around 30 USD/Metric tonne, essentially negating any benefit derived from increased competition amongst the fuel suppliers.

IATA has also highlighted that throughput fees should be cost-based in accordance with ICAO Policy on User Charges (Document 9082/7). The high throughput fees at Indian airports suggest an absence of correlation with cost which then makes them inconsistent with ICAO policies.

It would be a major setback for the Indian aviation industry if the high charges are not rescinded and consequently be used as a benchmark for throughput fees at other airports. The flawed methodology for introducing competition should also be ceased.

Fuel Hedging:

In its Annual Monetary & Credit policy 2007-08, the RBI has now allowed authorised banks to permit airlines to hedge their exposures in the international commodity exchanges, based on airlines' domestic purchases of ATF. For their domestic operation, the Airlines earlier had to procure ATF only through domestic refineries at International Prices. Since the carriers were not physically importing the commodity, the airline companies were not permitted to hedge the commodity risk. The Monetary Policy has now allowed actual users of ATF viz. the Airlines, to hedge economic exposure.

The announcement on the expansion of hedging facilities by the Central Bank, is a positive step which will allow the airlines to employ hedging as a tool to smoothen their exposure to the volatile fuel price movements. Hedging will allow airlines to reduce their fuel price risk to some extent – with a possible downside of incurring losses in case the price movement is infact against the hedged positions.

Allowing fuel hedging for the airlines is thus only a small step to bringing about moderation in the excessively priced ATF in India. This needs to be followed through by bringing down the base price of ATF charged by the oil companies; and also reduction in the levels of sales tax on ATF by the states, which are currently in the region of 20-35 %. ATF accounts for roughly 40% of the total operating costs of airlines; and is priced approximately 65% higher in India, than other airports globally.

RECOMMENDATIONS

A reduction in the cost of ATF cost has a significant impact on the airline balance sheets. A quick calculation to estimate the impact of a reduction in ATF price on the losses being registered by the Indian carriers indicates that a reduction in ATF price by 65% (to bring it closer to international benchmarks) results in a close-to 25% increase in operating profits. A mid-sized airline in India whose balance sheet indicates an operating loss of Rs 12,000 lakhs for the quarter ended 31st December 2006, would infact have reported an operating profit of Rs 3,000 lakhs for the same period if the ATF charges were closer to international benchmarks.

The distortion in ATF price by the domestic oil companies and the taxation structure results in a huge burden on the airline bottom-lines – making airlines in India uncompetitive and unattractive for equity capital and debt financing.

FIA believes that Rationalization of ATF prices for domestic operations, to international benchmarks will result in an estimated annual savings of USD 624 million for the airline industry. The following is recommended on a priority basis to prevent further losses for the Airline industry;

Tax Structure

- Customs duty on ATF for domestic operations should be reduced

- Excise duty on ATF should be made 4%

- ATF should be given "declared goods" status, thereby attracting a uniform 4% sales tax across India

ATF Base Price, Pricing mechanism & competition

- The Ministry of Petroleum & Natural Gas should instruct the state owned oil companies to provide immediate relief to the Airlines by reducing the base price of ATF.

- The ATF pricing should be made transparent by building in the various sub-heads in the billing process.

- The increases in ATF prices passed on to the domestic carriers should not be higher than the increases in the benchmark prices;

- The decreases in the benchmark prices should be fully passed on to the Airlines;&

- The marketing margins built-in by the oil companies in fixing the ATF prices should be reduced and competition be introduced in the supply of ATF by allowing private players to supply ATF at Indian airports.

ATF Distribution Infrastructure

- The current storage and supply facilities for ATF at the Indian airports should be converted to Common User facilities owned by a neutral agency instead of duplication of such infrastructure, by investments in separate facilities by the state owned oil companies as at present.